Originally published on 9 August, 2021 for Ohmresearch.

It is hard to break the cycle of not worrying about Germany. But you should.

Almost 16 years of Chancellor Angela Merkel and a clear path of negative rates from the European Central Bank (ECB) can make a person complacent.

Add that to the European Union’s 2021-2027 budget including its “Next GenEU program” and the Recovery and Resilience Fund (RRF) and it is even harder to break out of that complacency.

Unfortunately, we need to turn a more critical eye on the country and its political choices. In September’s Bundestag election, German voters are making decisions that will truly affect everyone.

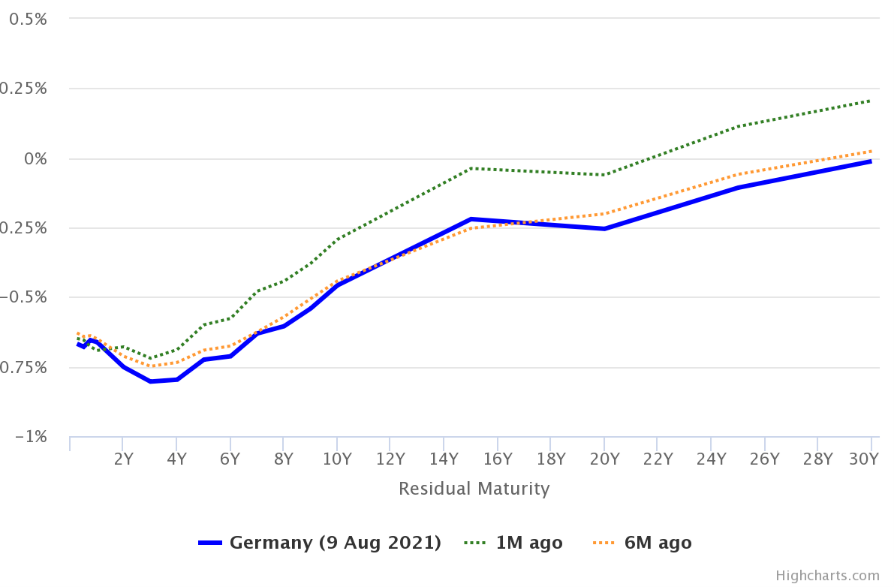

It is hard to imagine what could happen that would shock German Bunds out of negative yielding territory. Even the German 30 YR is headed back negative after a brief sojourn into positive yields. The election result in September is unlikely to do it. It doesn’t mean you shouldn’t worry.

German Yield Curve

No ECB decision is likely to rocket yields higher in the short term either. At its 22 July meeting, the ECB said it would keep buying bonds to support a Eurozone recovery. New language about tolerating moderate inflation and a transitory overshoot may have upset Jens Weidmann but honestly, what has the ECB done in the last 15 years that hasn’t upset this uber hawk.

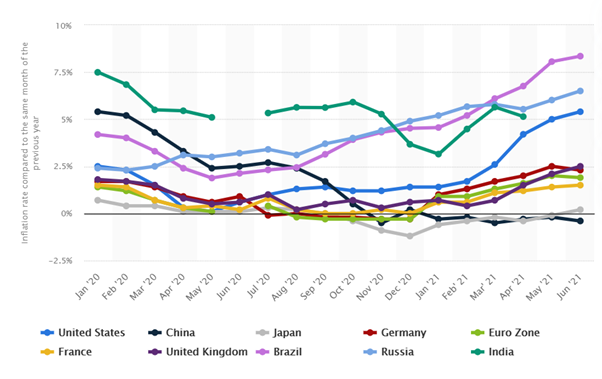

Global inflation numbers are giving the whole world a bit of a wobble. Inflation in the 19 countries sharing the euro accelerated to 2.2% in July from 1.9% a month ago. In Germany, July inflation beat expectations of 2.9% coming in at 3.1%. This is expected to continue to tick up as the economy reopens and new measurements of the basket of goods feed through.

YoY June 2021 Inflation

Source: Statistica

However, the ECB continues to view this spike as transitory. The same story is putting pressure on central banks and markets in the US as well but it will take a bold and confident central bank to raise rates now.

The big caveat here is I’m talking about developed markets. Emerging Markets are already hiking. We’ll talk about that shortly.

But the EU is haunted by its reversal of accommodative policy too early during the global financial crisis and the sovereign debt crisis. Even if you think the pendulum has gone too far towards easing, there is no appetite outside of Weidmann, and possibly the Dutch, to tighten either fiscal or monetary policy. The EU’s 7-year budget and the RRF will keep fiscal expansion in place. It doesn’t mean you shouldn’t worry.

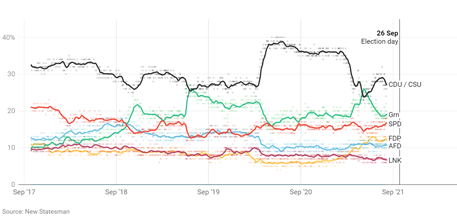

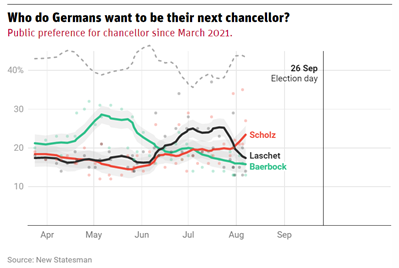

I thought that the Greens’ strong momentum earlier in the year held so much promise both for Germany and the EU. Now the chances of meaningful change to the European status quo are diminishing alongside the Greens’ polling.

Voting Intention for the September 2021 Bundestag election

The US’s blessing of Germany’s deal with Russia over Nord Stream 2 only entrenches that status quo further. Nord Stream 2 and Merkel’s international lobbying for it leaves no space for the next German administration to move away from fossil fuels or Russian energy sources.

The US was rightly concerned that an unchecked Russia with an even greater ability to manipulate energy supplies to Europe might pose a danger to Ukraine, Europe, and themselves.

However, the US found a way to deem Merkel’s pledge to act on any undue pressure from Russia as sufficient. This is despite the fact the pledge is so vague that it wouldn’t even keep my 4-year-old in line.

Now that Merkel knows she is headed out of government, is she’s eyeing what other chancellors have done in the private sector? It would make for an easy transition since she’s already lobbied for the organization with other governments. Though it would break the hear of many a Merkel fan. However, I took her photo off my mantel a couple years ago.

Merkel provided such strong and steady leadership in Europe throughout the global financial crisis and the sovereign debt crisis. Her actions anchored the EU.

However, the truth is that Germany was the leader for crises but not for change. Merkel was able to control the panic but not craft a long-term solution or put Germany or Europe on a path for the next generation.

The Greens seemed perfectly poised to take over from crisis to planning, or truth be told, from economic crisis to climate crisis.

But alas, the Greens stumbled too. Unfortunately, none of the candidates across the parties are connecting with the voters. There is a real risk of a weak chancellor. Without leadership in Germany, the EU will likely fail to move from crisis management and fighting about EU harmonization . And leadership in Germany looks in short supply. This is when you should worry.

Feel free to file under: AAA-RATED COUNTRIES CAN AND SHOULD KEEP YOU UP AT NIGHT.