Originally published 14 October 2021

Boris Johnson is using Brexit to distract voters from what matters. Still. The UK has a bad case of Long-Brexit, and it will slowly eat away at the country’s pandemic recovery potential.

There is so much going on in the UK right now beyond Brexit. Some of it is the government’s fault, some of it not. Regardless, the government’s job is to smooth economic cycles, protect the most vulnerable, and provide public goods.

The Johnson administration is failing at all three and setting the country up for short- and medium-term pain.

Let me caveat all my great proclamations with this: we are very much still in the pandemic and very much still in a complete supply and demand dislocation. These challenges are global in nature and unprecedented. Developed markets have done well with providing liquidity during the height of the pandemic. Now they must move from crisis management to planning for the recovery. This entails trimming of excessive liquidity and long-term planning.

Alas, I dream of long-term planning governments, and then I wake to reality.

The UK government is not making any long-term plans. Instead, it is sticking with the same plan since 2016. Brexit, Brexit, Brexit.

Boris knows his original backers are mostly unaffected by the dislocations due to the pandemic. They continue to be mostly in an economically insulated bubble. The anti-EU rhetoric and inflammatory soundbites on Brexit keeps them on Boris’s side.

In a wonderful confluence of interests, ‘winning’ on Brexit also keeps the marginal Boris supporters happy.

It seems to distract them from 1) the end of furlough 2) mismatch of skills to labour market 3) looming higher energy costs 4) looming tax increases 5) looming rate hikes and 6) a trade war with the EU, their largest trading partner.

When anyone brings up 1-6, Boris reverts to Brexit. Does it reassure the country that as long as the European Court of Justice or Brussels isn’t telling them what to do, it doesn’t matter if they can afford heat or buy food for Christmas?

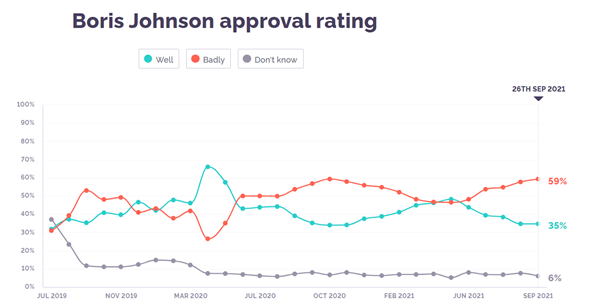

Boris is sticking to his Long-Brexit mantra regardless. It doesn’t seem to be helping him keep afloat in the polls. But with no election on the horizon and no functional opposition, why not take the easy road of continuing to beat the Brexit dead horse versus actually working at his job?

Boris shares more in common than just hair colour and number of wives and chidren with the former American president, he shares the canny ability to dodge political damage despite being significantly incompetent. As much as it will pain them to even consider the thought, Labour needs to look to the US and see how Democrats were able to challenge Trump at the poll box if not on soundbites. Then there may be hope for the UK when there is an election.

In the meantime, Gilt 10 YR yields are rising. Expectations that the Bank of England will raise rates are now firm with a heated debate about just how soon that will happen. February 2022 at the latest and possibly an early November surprise.

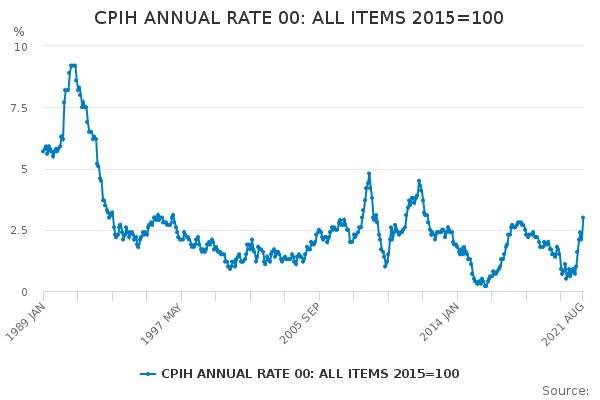

The imminent hike is on the back of a surge in inflations in August. Consumer Prices Index plus housing costs (CPIH) reached 3.0% in the 12 months to August 2021, up from 2.1% in the 12 months to July. This 0.9% increase is the largest on record, but it is largely attributable to base effect.

3% is high and compared to August 2020 at 0.5% it looks horrific.

However, remember last summer when we were all eating out in the UK but only paying for half of what we ordered as the government picked up the rest of the tab? That pushed down inflation significantly and now that we are forced to pay for our own food, shocking as it may be, inflation is surging. But the BoE isn’t buying the transitory inflation story.

Sterling is strengthening against the dollar and the euro as well. Neither gilts are sterling look attractive if, unlike the government, you can manage a little forward-thinking.

Today actual GDP data doesn’t look bad in comparison. August 2021 say a 0.4% growth in GDP over July. July was revised down to -0.1% from 0.1% growth. This is still 0.8% below its pre-coronavirus (COVID-19) pandemic level (February 2020). This is roughly better growth than seen in the US or Europe currently. However, expectations are for growth to slow from here on.

The full force of the gas price increase is unlikely before April 2022 given how the regulatory system works in the UK. April 2022 is when the new National Insurance tax hike is scheduled to come into effect. Will the Winter of Discontent actually turn into the Spring of Discontent?

Employment data has also continued to improve but with the Furlough scheme still on the books it is hard to see through the noise. We’ll start to have a clearer picture with October data after the formal end to the Furlough scheme on 30 September.

The labour shortage is also something batted off by Boris. His suggestion is that there is just a period of adjustment and that we shouldn’t resort to immigration is challenged in both the near term and the medium term.

A recent study by the Institute for Fiscal Studies suggests the surge in vacancies has been driven by low-paying occupations, where new job openings had risen about 20 percent above pre-pandemic levels by June 2021. But that almost 8 mln people, a quarter of the workforce, in higher-paid service jobs would struggle to find employment.

This does not suggest that the UK post-Brexit is gearing up for growth and expansion anywhere but in the low-paying sector. That doesn’t sound like a winning combination for recovery.

The UK is being bogged down by Long-Brexit. Unlike long-covid, there is a cure: a functioning government not distracted by the endless project that is Brexit. And it will benefit many more than the empty promise of freedom from the tyranny of the European Court of Justice.

Feel free to fill under: POLITICIAN, HEAL THYSELF, OF LONG-BREXIT