The violence in Colombia is a result of several health, social and economic pressures erupting at once.

They are not unique to Colombia and can easily be imagined in other countries in the region and emerging markets in general. The health, social and economic crises are all leaning heavily on fiscal stability that is making investors and rating agencies nervous.

The International Monetary Fund (IMF) has given its blessing to grow fiscal deficits. Is that only for developed markets though because emerging market investors don’t seem convinced it will be ok on the other side of the pandemic?

Colombia’s fiscal problems, like many emerging market countries, aren’t just a product of COVID but they were definitely magnified by the pandemic. Assessing whether the government can turn the ship post-COVID is how emerging markets investors will make money. If the governments try to front-run expectations of fiscal tightening, possibly to avoid a rating downgrade and curry investors’ favour, it will likely be detrimental for the medium-term outlook as they own viability.

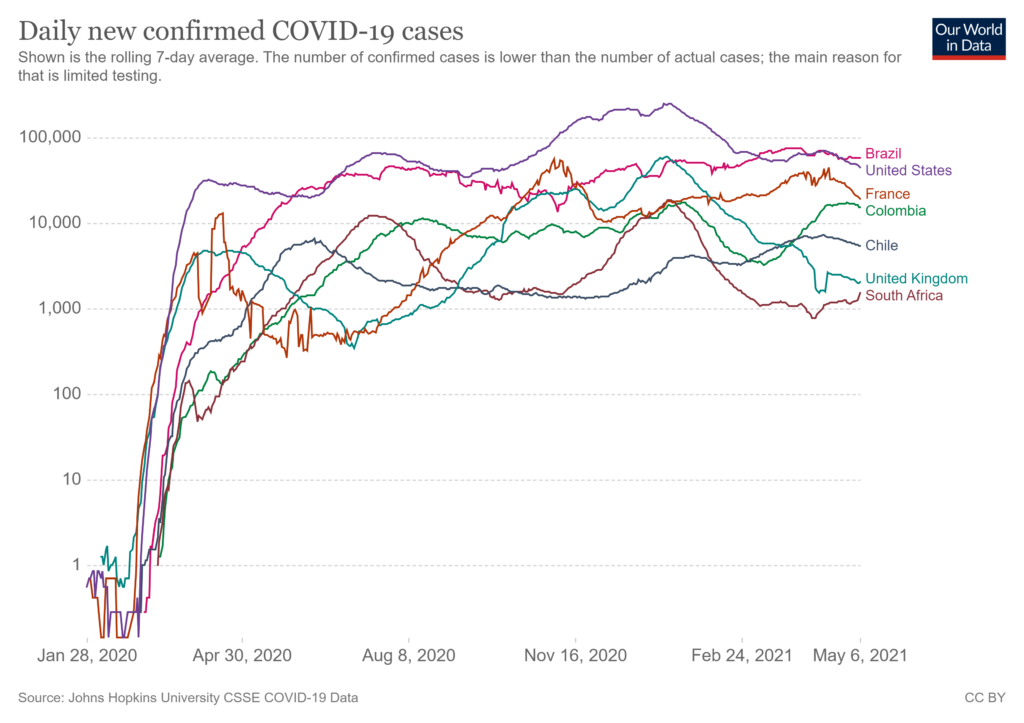

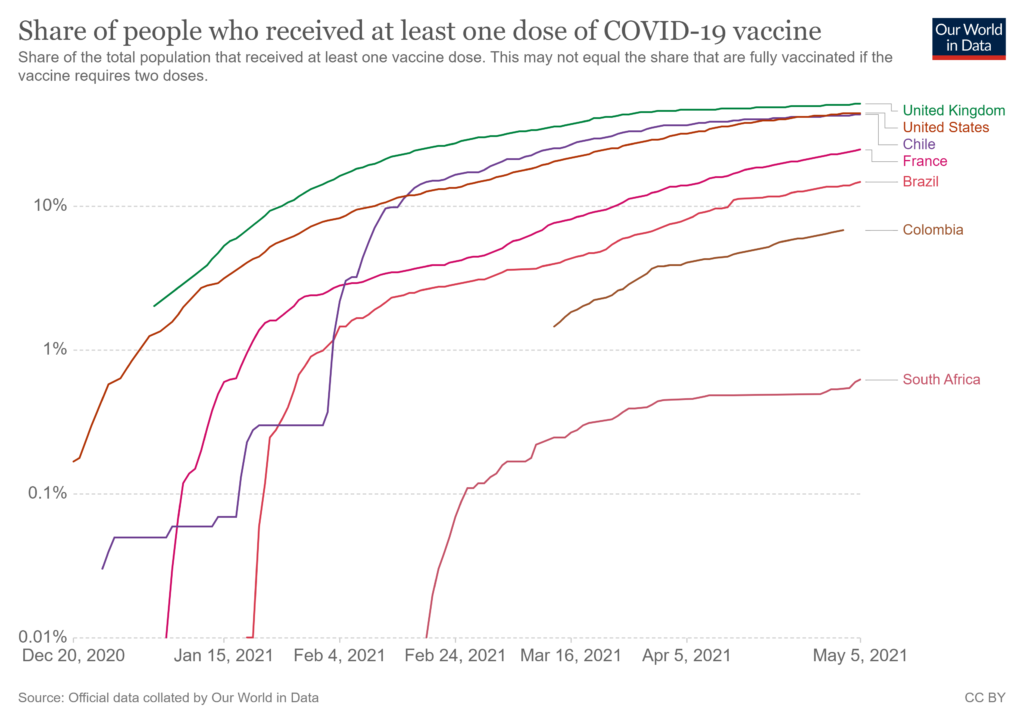

It is premature to speak of a post-COVID recovery and premature for governments to think of reigning in spending in emerging markets. COVID is still very real amongst its populations and the health crisis and the resulting economic crisis is still very real despite developed markets out at the pubs and planning holidays.

The IMF continues to tell countries not to worry about deficits, however, investors and rating agencies are already worried about what fiscal stability looks like for emerging market countries on the other side of Covid. That is what good analysts do. Though it misses the actual circumstances on the ground.

Maybe zoom due diligence trips aren’t efficient after all.

What we are seeing now is Colombians reacting to what they perceive as swift kick while they are already down. There wasn’t much confidence in the Duque administration from day 1 but after 18 months and a health and economic pandemic, faith in the administration is zero.

Colombia needs fiscal reform. The country has a narrow tax base and could do more to promote investment. There are many aspects of the failed reform that make sense. Those aspects were lost to headlines alerting many to their new tax liabilities and an increase and expansion of VAT to basic items. The administration’s inability to talk through the reforms and try to win any understanding compounds the fears that this entitled and isolated administration cares nothing for the continuous suffering on the streets.

Then we have the reality of a violent response to protests. Colombia is a country globally associated with violence but has made phenomenal strides towards rule of law and peacefulness. Not only the peace accord with armed militias but on the street as well. Murders per capita have plummeted from the highs of 84.2 per 100,000 in 1991 to 24.3 per 100,000 in 2020. What is going the other way is the brutality. The number of massacres, defined as more than 3 murders simultaneously, has grown. There were 90 massacres in 2020 up from 36 massacres in 2019, 29 in 2018, and 11 in 2017.

Colombians have suffered brutal violence this past week. Both police and protestors have been killed and injured. This is a population at the end of its tether and being asked to face continued uncertainty about any return to normal or any return to growth from a completely out-of-touch administration.

It doesn’t take a lot of creativity to see the same situation playing out elsewhere in Latin America or elsewhere in the emerging market world.

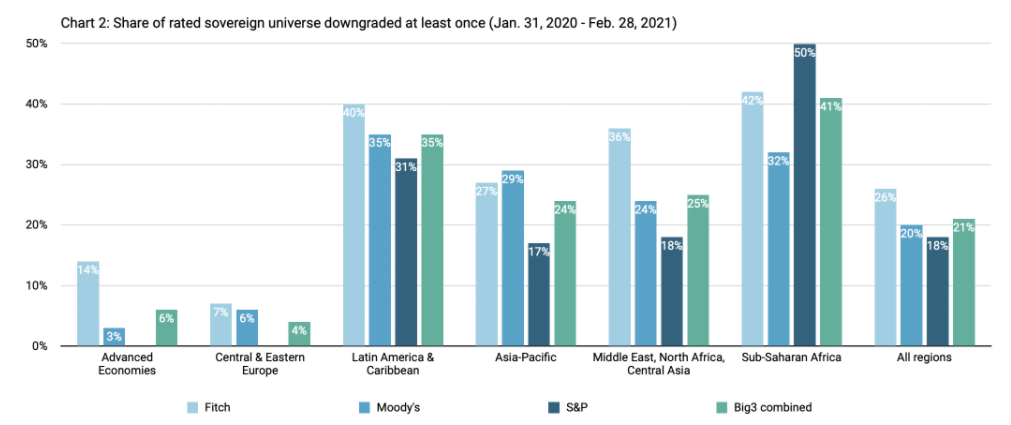

It is a very tricky time to assess sovereign creditworthiness. The growing balance sheets globally are encouraged and needed. Make no mistake though: there will be a very different lens applied to emerging markets than developed markets. Investors and rating agencies appear to ignore the US and others’ expenditures, except in the context of possible inflation. However, emerging market downgrades are mounting.

Source: CountryRisk.io

There aren’t a lot of administrations or institutions in emerging markets that inspire blind confidence but if one were to, it might be Colombia. It lives in a neighbourhood of chronic defaults and doesn’t. It has repeatedly made the right fiscal choices but now it is facing falling below an investment-grade rating and incurring the forced selling and higher borrowing rates. It can’t all be blamed on COVID but there is a lot that can.

The country will avoid a downgrade because the new finance minister, José Manuel Restrepo will do enough to soothe all interested parties. And the global attention regarding the violence and rejection of austerity during a still very real pandemic will be enough to make the rating agencies hold steady.

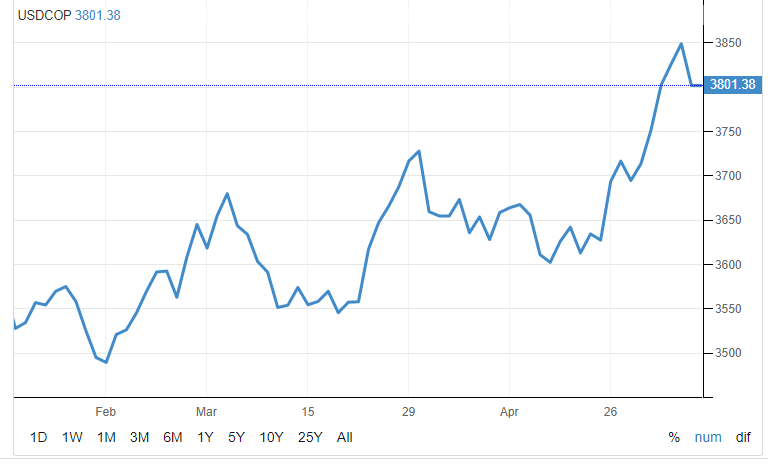

There has already been a bounce in Colombian assets after the resignation of Alberto Carrasquilla and the appointment of Restrepo, a non-political figure already using the right language and enough fiscal levers to ease tensions.

Source: Tradingeconomics

The question of how to gauge an emerging market country’s ability to tolerate the health, social and economic crisis’s toll on its balance sheet will remain. This time last year, the IMF and the whole emerging market ecosystem were calling for building back better. It is hard to identify any spending that contributes to the future when all resources are dedicated to surviving today.

There has never been a harder time to price risk. The global pandemic, IMF’s support for deficit growth, the Debt Service Suspension Initiative, and high global liquidity all combine to cloud fundamental analysis.

But investors still have to invest. Where to go then? I’ll take a crack at sorting that answer in the next missive. My response will weigh heavily on whether administrations across emerging markets learn anything from Colombia’s attempt to tighten the purse strings too early.

Feel free to file under: THE FAT LADY HAS NOT STARTED SINGING YET