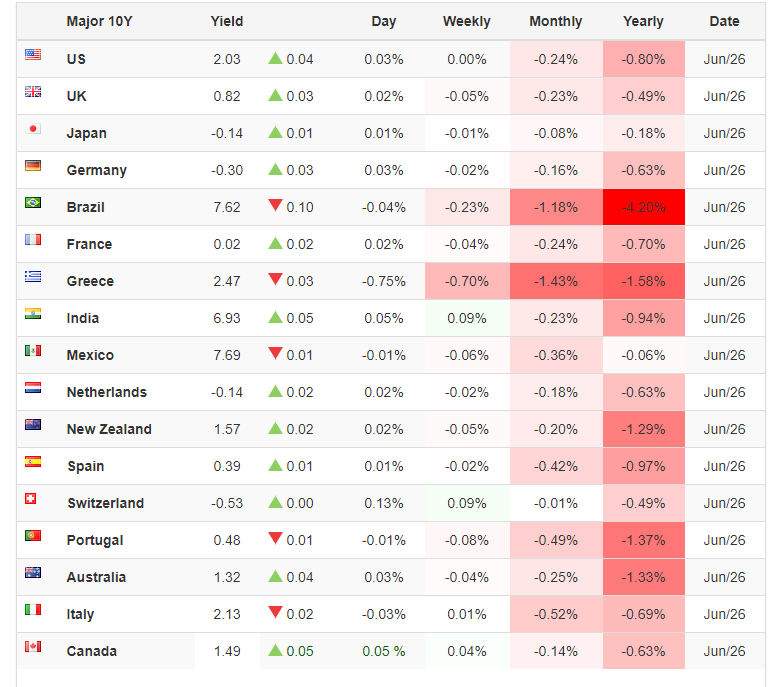

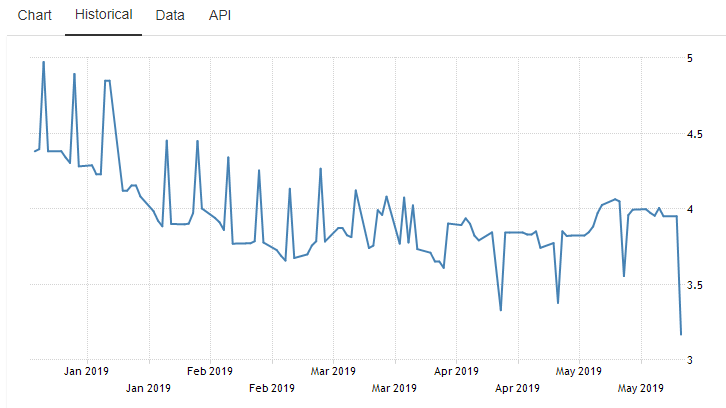

Central Banks have been pretending its Halloween for way too long with their low or negative interest rates; scary world, scary things a happening so have some free candy. The Global Financial Crisis and Sovereign Debt Crisis was scary but they are over now. Shouldn’t the free candy and negative and low interest rates be over now too? They should be but they aren’t and there is minimal chance of that changing. The challenge now is to figure out how to survive negative interest rates in the meantime.

Today is the day between Halloween and Dia de Muertos. Two holidays kind of in cahoots but not really and both looking backward rather than forward. While I enjoy free candy and also celebrating dead friends and family, I also want to look forward. Forward to a time when central banks are in the position to raise interest rates. How are the three things related you ask? I love Halloween, Dia de Muertos, and Central banks, and I’m the author, that’s how.

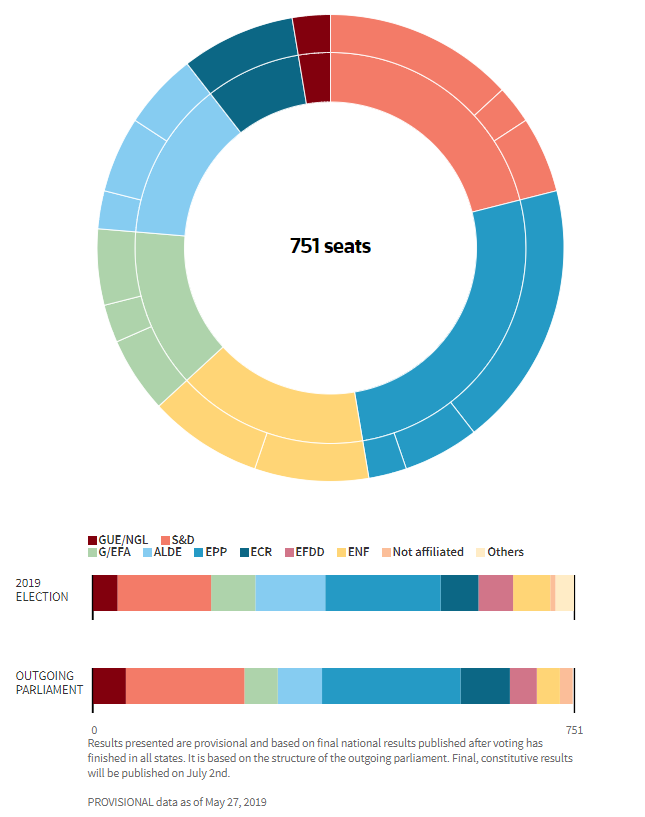

Today is also Christine Lagarde’s first day in office and Mark Carney only has 3 months left in his mandate. Despite those changes, I don’t think central bank policy in either the UK or the EU will change much. As much as I love central banks, the time has come for the fiscal side to take the lead. This is as scary as Halloween given the state of politics but unfortunately, we have few options.

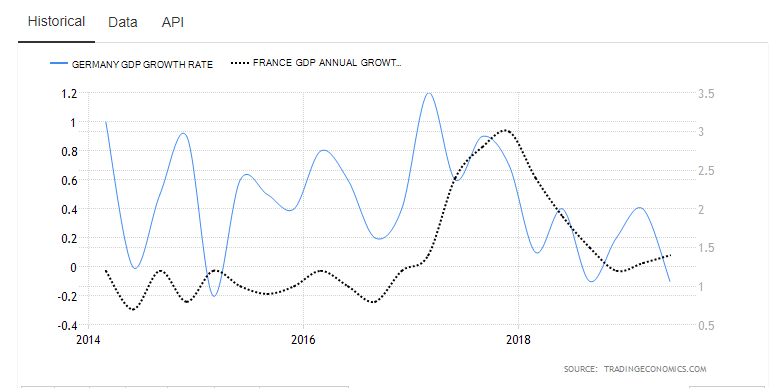

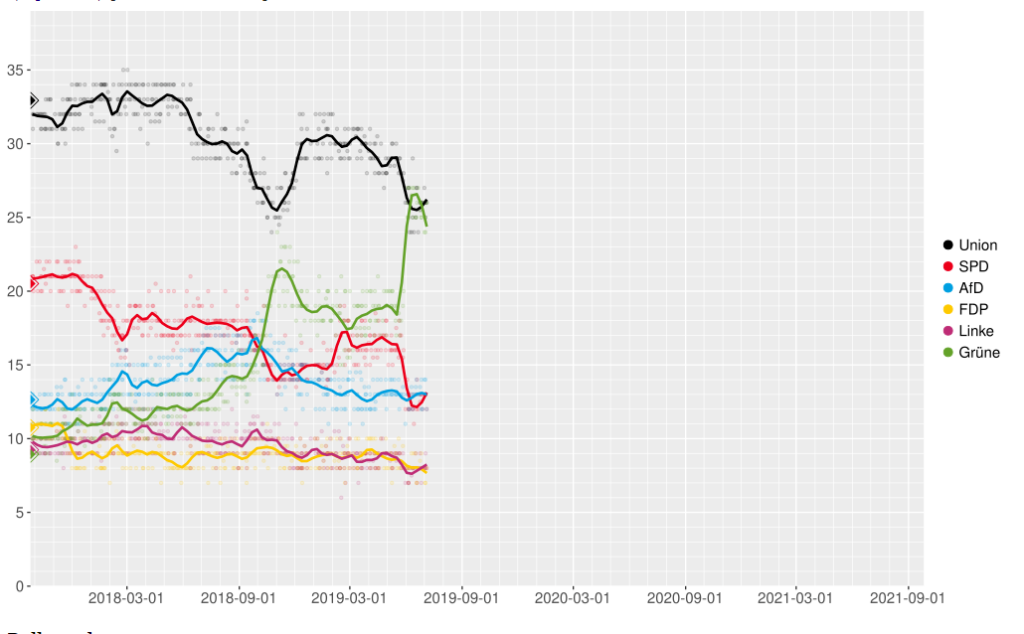

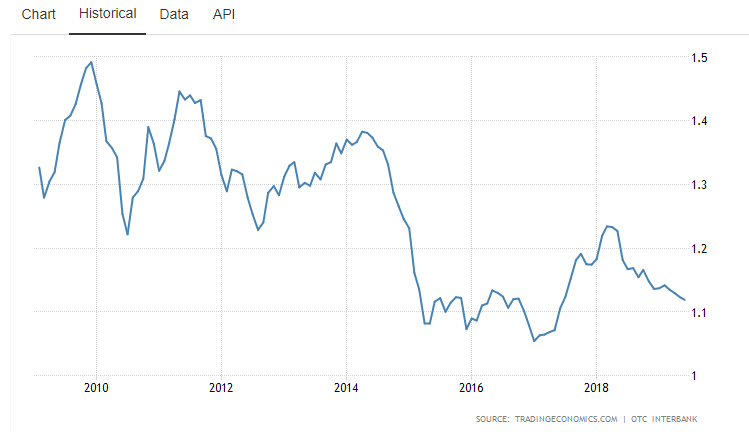

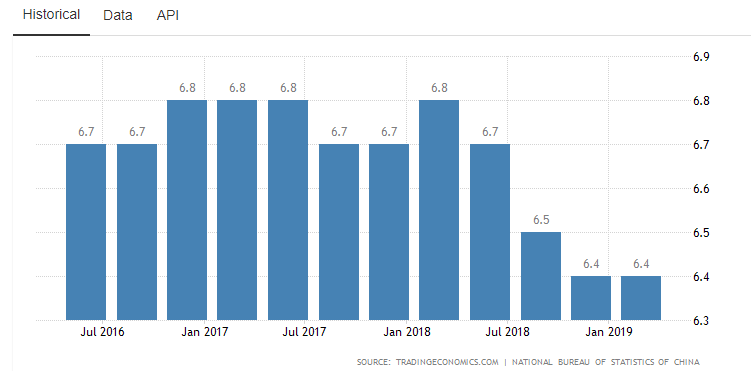

I wrote previously about how I think the environment is ripe for Germany and the EU, in general, to move away from its balanced budget mania and focus on true growth-enhancing fiscal policy. I still believe this is the case but it will not be an overnight development. The future in the UK is less transparent given its Brexit issues. However, I still view it as a rather safe bet to assume the BoE isn’t hiking rates anytime soon.

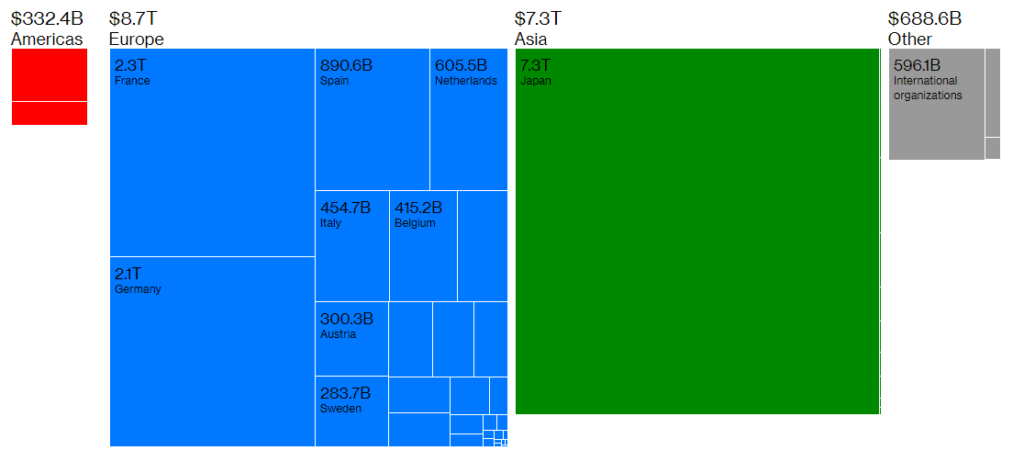

In the meantime, what’s a European sovereign debt investor to do? Where is one to turn to when its negative rates as far as the eye can see? Do I as an analyst, stick with the fundamental analysis that has guided me well so far? Or do I lean more on technical aspects supported by the view that the bond rally, supported by declining liquidity, forced holding and no foreseeable movement in interest rates continues to have legs?

Relying solely on one or the other is like going into the basement to check the fuse box after all your friends have been murdered in your living room. It is unlikely to end well.

As with any challenging environment, you have to combine the two aspects. No one, unless it is in your mandate, forces you to hold a bond to maturity. People all the time make money selling bonds before their maturities. Don’t tell me you bought Austrian centuries bonds and you are prepping notes for the analysts who fill your spot after retirement and death. Though they could check in with you on Dia de Muertos and let you know how the bond is doing. So let’s cut the bruhaha about bonds and capital gains.

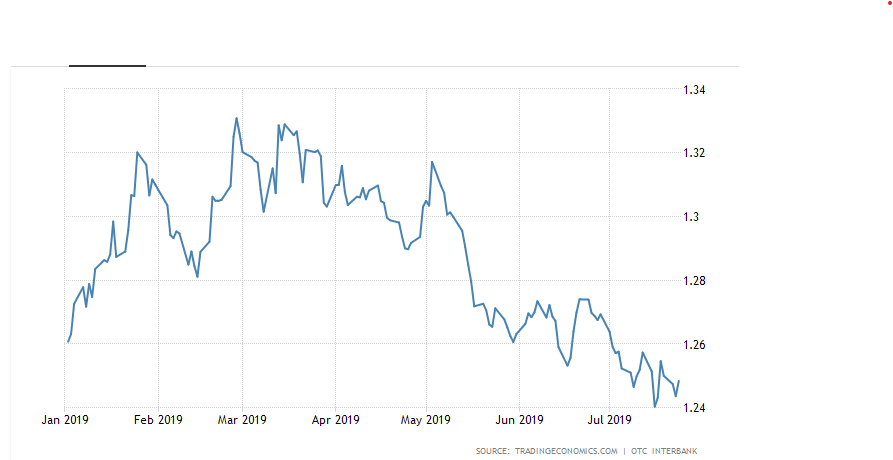

There is also currency hedging and futures to look at in terms of opportunities in a negative world. This is the beauty of combing a fundamental analyst, a portfolio manager, and a good trader because they can explore the fundamental and the technical in a market environment that demands both. That’s how we will survive all the free candy and avoid having to go into the basement.

Feel free to file under HAPPY HALLOWEEN, ALMOST EVERYTHING IS RIDING ON YOU, CHRISTINE