Two things have changed that could trigger the death of the Great German Schwarze Null, the county’s self-defeating budget policy. That death would herald a new chapter of German leadership as the country implemented and therefore, blessed, fiscal expansionary policy in Europe and provided the fiscal heave to monetary policy’s continuing efforts to boost European growth.

1. Germany is no longer the strongest in the EU, either economically or politically (internally or externally).

2. Christine Lagarde is about to take over at the ECB.

This new environment creates the space and impetus for Chancellor Merkel to deviate from the well-trodden path of Germanic fiscal restraint ahead of her retirement.

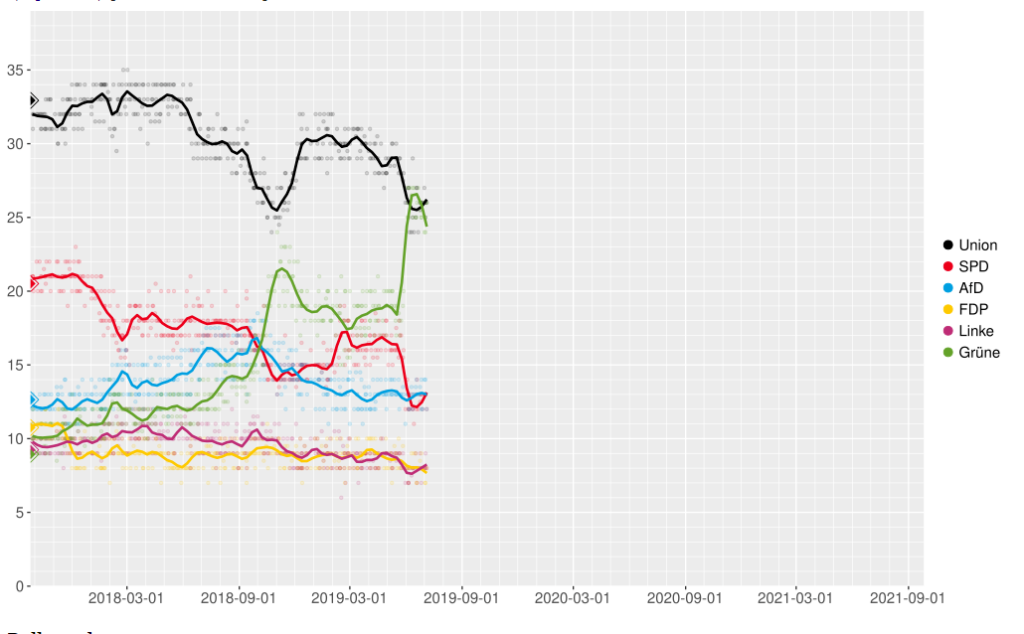

Chancellor Merkel led Europe through the sovereign debt crisis. She walked on water domestically as well. Since her brave statement welcoming Syrian asylum-seekers to Germany, her popularity has waned as has Germany’s economic prowess. That economic weakness coupled with her declining popularity and an already telegraphed exit creates the space for a change to fiscal policy.

Source: Civey (SPON-Wahltrend)

Last week’s government announcement of a EUR54 bln spending package to reduce emissions is the first step. While it won’t save the Polar Bears from day one, it does restore some climate change credibility to the administration which should be helpful in the polls. It is not a full stimulus program by any stretch either but baby steps! We are talking about Germany and the Schwarze Null! They bake cakes and take photos with the Schwarze Null.

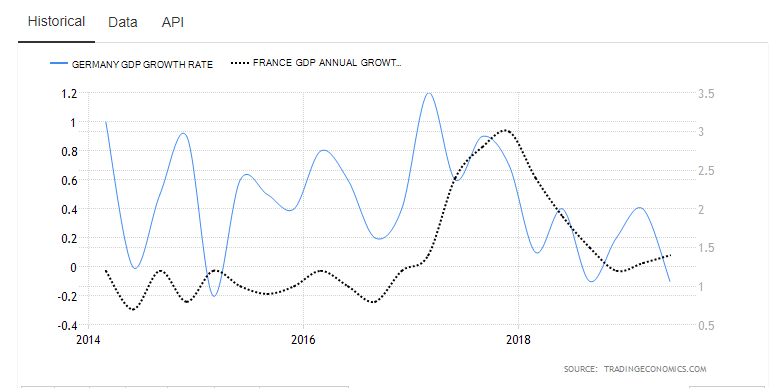

Even though Germany stares down the barrel of a technical recession with 3Q2019 numbers anticipated to be negative after the contraction in 2Q2019, it is still too early for the Germans to throw stimulus at the problem. But what if you had a very savvy head of the ECB who has spent her career talking politicians into doing things they don’t necessarily want to do?

Enter Lagarde! Draghi has laid the extensive monetary policy groundwork for her to focus on her strength: political wrangling. If anyone can talk the Germans into thinking twice about the oppressive zero they’ve yoked themselves to, it will be her.

If the German administration acts quickly, it may be able to strengthen its climate change credentials, support growth and knock the wind out of the AfD. But that is a tall order.

Technically though, there is room. The Schwarze Null is not enshrined in law. The debt brake is but German officials are already speaking about using off-balance sheet vehicles to manage that. I wonder where they got the idea?

German fiscal expansion would be positive for all European assets. It will not drag Bunds out of negative territory, but it would contribute to growth and inflation. There is a line that connects today’s fiscal stimulus by Germany with an exit for the extraordinary monetary policy at the ECB.

That should be sellable to German voters and investors.

Feel free to file under OKTOBERFEST WILL BE EVEN BETTER NEXT YEAR