My guiding light during times of crisis has always been a little scene from the 1988 film Colors with Sean Penn, Robert Duvall and directed by Dennis Hopper. None of the language is appropriate but the gist is you have to be patient. Patience is a key requirement for looking at Emerging Markets and basically everything else. It helps you think straight when markets move like they have with Coronavirus or you are on your second marriage.

Patience is part of the three amigos of creative thinking and assigning probabilities. If an analyst can manage to keep all three of those in check while a portfolio manager yells at them, the screens are red and fundamental analysis doesn’t seem to matter, then there is hope to survive a market rout.

Right now, everyone is trying to be a virologist and savvy about calling a bottom. I’m going to take a lesson from my long, illustrious 5-day career of home-schooling to declare stick with what you know. What I know is sovereign debt analysis. I’ll try to apply that thought process to Brazil and Turkey and see what we get. Remember, patience is good for me and you!

By the way, Brazil and Turkey make a nice little pair. Leaders of both countries are under the assumption that they themselves elevate the credit quality of their countries and they are both wrong. Look at the currency, the credit ratings as well as the declining popularity. Jair Bolsonaro and Recep Tayyip Erdogan believe their own hype and their own cult of personality. They are both bringing unnecessary pressure on their economies without the growth and prosperity they’ve promised their populace.

Bolsonaro wears proudly the moniker of ‘Trump of the Tropics.’ Trump has squandered the US’s moral high ground and its global leadership. Trump has stripped the US government of the brain capacity to do much except for trying to keep the stock market at or above a certain level. Which lots of people might say doesn’t matter in the grand scheme of things. I think it does; ask Venezuela about the importance of institutions and smart bureaucracy to keep de facto dictators in check and economic Armageddon at bay.

The US retains its global standings but only as a shadow of what it was before. Brazil doesn’t have that far to fall nor currency reserve status to buoy it. Luckily Bolsonaro isn’t quite as destructive as Trump. Brazilian institutions are looking increasingly resilient; Congress is strengthening from its previous position as a rule-taker. States are independently taking action when Brasilia fails to act. The Lava Jato experience strengthened faith in the judicial system. The passage of the pension reform suggests that weights on the fiscal side may ease going forward. Brazil could survive Bolsonaro yet. Though this little global pandemic complicates the future.

On the flip side, Erdogan has weakened the majority of Turkish institutions in his quest to consolidate and extend his reign. There are movements afoot to wrest control from him. Long-time Erdogan ally and founding member of the AKP, Ali Babacan announced the formation of a new party in March 2020. Deva, or ‘remedy’ in Turkish, is set to challenge the AKP and what Babacan has labeled as the destruction of Turkish institutions. Only a few months earlier, former prime minister, Ahmet Davutoglu left the AKP and established the Future Party to rival the AKP. The rerun of the March 2019 mayoral election in Istanbul that resulted in the June win of Ekrem Imamoglu as well as the original victory in Ankara mayoral election for the CHP candidate also signals that Erdogan and the AKP are losing their grip.

Coronavirus and the threat of severe economic depression have thrown Erdogan’s usual tools of anti-Kurdish rhetoric and military action, continual tussles with Russia over Syria and manipulation of the refugee situation with the EU out the window. Erdogan is looking increasingly weak. Elections aren’t scheduled until 2023 but the view that Erdogan may not last that long is gaining traction.

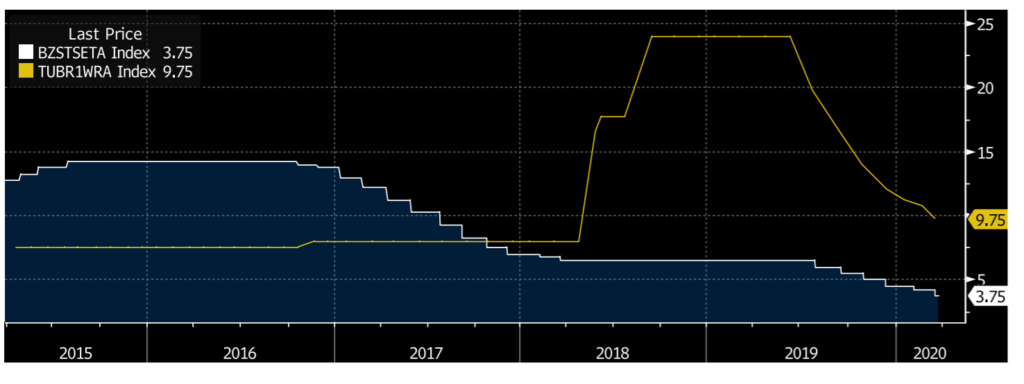

For the investor, Brazil and Turkey are big emerging market markets. Brazil accounts for 3.27% of the JPM EMBI Global and Turkey, 5.73% making them the 8th and 5th largest components, respectively. Within this USD index, Brazil has returned 4.13 YTD and Turkey -1.42 YTD. JPM’s GBI-EM index, which is made up of local currency bonds, has Brazil unhedged performance at -9.03 YTD and Turkey -6.21.

Dollar strength during this crisis isn’t a newsflash. It is expected as a flight to safety, plus EM countries have cut rates like it is going out of style. Both the Real and the Lira have been beat up pre-Coronavirus as well but hard to say they are cheap now. Domestic factors might suggest a buying opportunity but this is a USD story and not a Real or Lira one.

Low growth and negative views on Brazil and Turkey are lost to the wider Coronavirus market meltdown. Unfortunately now is the time to examine what developed markets can do as that will be a stronger influence on currency and economic outlook. Everyone quickly switches from a virologist to a Fed analyst.

Developed market central banks and governments are coming out swinging which is positive but there is still too much unknown to hazard a guess on if it will be a short and deep or long and deep crisis/recession/depression at this point. Brazilian and Turkish authorities have also cut rates and announced some measures but the message isn’t consistent and the response is limited. While the countries have larger fiscal space than historically: Brazil recorded a multi-year low in 2019 at 7.1% of GDP and while Turkey sailed past its 1.8% of GDP target to 2.9% of GDP, mainly due to election spending, it is still smaller than previous years. Historically, the quality of the spend is low and the effects limited and short term. Poor execution doesn’t give confidence that announced fiscal programs will have the power to change the growth trajectory of these countries.

There is no reason that either of these countries will uniquely buck any downward global trend. While Turkey will benefit and Brazil suffer from low oil prices, that will not be enough to override a decline in global consumption and trade with developed markets.

There are a lot of vulnerable EM countries; Brazil and Turkey are only two of the biggest ones that might have been working on borrowed time. There are a significant amount of countries looking at real fiscal pressure with unsustainable debt maturity profiles. The IMF is standing at the ready but we might start to think about if IMF assistance will be the same or look different. Different and less benign to investors.

Brazil and Turkey will not decouple from EM as a whole but they are definitely higher quality with better prospects than the majority of recent entrants into the EM space. There is a realistic path that can be plotted towards a turn-around in these two countries. Bolsonaro won’t be in power forever and there is renewed faith in Brazilian institutions. Coronavirus may accelerate Erdogan’s exit with some capable alternatives for leadership already on the horizon. Compared with other EM countries that gluttonously issued debt over the past 18 months, Brazil and Turkey, look like stable EM countries with only temporary challenges brought on by its current leadership.

In the meantime, it will be a painful process to sit through the market volatility and the specific market pressure that will come to bear on these countries as well as global population in the face of this pandemic. Almost as painful as switching to fulltime parenting. But like I tell the kids, you’ve got to be patient. Do your homework and be patient. But do it in the other room!

Feel free to file under TIME TO WATCH 1980s MOVIES