Before you decide to read this on your personal device, don’t worry, it is about sovereign debt. Developed Market debt is boring. Boring is never sexy, or at least that’s what we thought when we were young.

There was an interlude when Developed Market sovereign debt was the most interesting game in town. Greece, Iceland, and Eksportfinans brought the mostly dismissed asset class into the spotlight. But now we are back to the boring: predictable government policies and transparent, or mostly transparent, balance sheets.

Except with negative rates and declining net issuance as well. Just to add insult to injury, there is just enough economic growth to keep the EU from bickering amongst themselves and push down any potential political risk. It could drive an analyst to distraction.

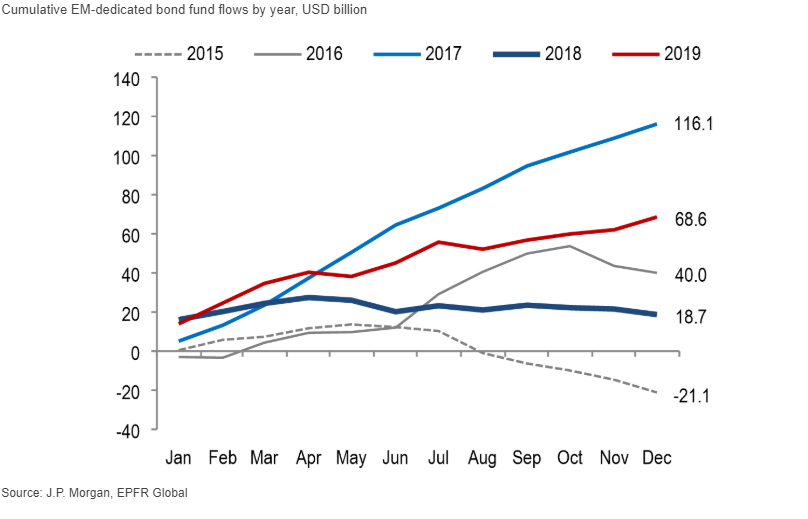

Emerging Markets are sexy. Emerging Markets is where it takes a detective working both the quant and the qualitative side of things to hack out the investment thesis. Or it did at one point. Now there’s enough liquidity sloshing around that this type of sexy is a bit end-of-the-night, too-much-to-drink faux sexy.

It is a hard job if your mandate restricts you to high-quality sovereign debt and you are expected to make a return. There’s the folk who use to make a decent, though low return, and that fit their risk profile just fine. Then there’s those who have no choice. Regulatory capital requirements force a fair bit of buying.

In addition, the whole view of hold-to-maturity is changing. High-quality sovereign bonds bought for their safety and interest payment are now viewed as a price appreciation play and capital gains opportunity.

I am the first one to put my hand up and say that I did and continue to think you buy Italy on any weakness. In this environment, I think that’s the wisest choice in a sovereign only universe.

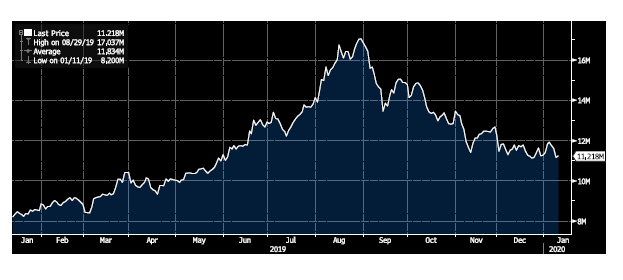

There is no change on the horizon that will change the current situation. Unfortunately, the Euro area is growing just enough to keep it out of emergency measures but not enough to count out additional expansionary policies from the ECB. The 1.2% outlook for GDP growth in 2020 and much the same in 2021 doesn’t support any change in the ECB’s dovish stance. Inflation expectations, as measured by the world’s favourite indicator, shows an increase but still a long way until near, but below, 2%.

Oh, and the net supply of euro-area sovereign debt continues to tick down, with German bunds leading the way. The likely fiscal expansion program in Germany is still not likely to be sufficient to move the needle on net issuance.

In the meantime, its spread compression everywhere as far as the eye can see. Close that eye in special cases like Venezuela, Lebanon, and Argentina. But those stories are truly idiosyncratic. Oh and EM issuance is expected to decrease for 2020 as well.

I remember very vividly in early 2007, a senior EM sell-side guy telling me a little pearl of wisdom. Sometimes you have to decide to get on the train or run over by the train. It is not a nice position to be buying things you don’t like at the current valuation. It is very much not sexy. But cash is even less sexy.

Feel Free to File Under DEPRESSING THOUGHTS ABOUT THE MARKET