Poland and Hungary love poking the EU bear. It plays well domestically and corresponded with easy economic and fiscal times. There has been almost zero downside to their strategy.

What Viktor Orban in Hungary and the Law and Justice (PiS) party in Poland don’t realize, is that eventually, the bear always bites. While they try to sell the conflict as between Brussels and the countries, it is actually between them and the voters. Brussels is a convenient target to distract from the damage these administrations are doing to their countries. In Poland and Hungary, it might just be the voters and not the EU, that bite first.

This anti-EU movement was one aspect of the platform that brought PiS to its unprecedented victory in 2015 and has kept them in power since. PiS won by drawing on the general disenchantment with the liberal elite and the specific feeling of missing out on economic opportunity felt by the population outside of Warsaw.

Several other factors contributed to their victory. The opposition was disjointed as its former leader and perfect poster child for European-centric elites, Donald Tusk, was busy as then-current president of the European Council. Good economic times also contributed to the victory.

While anti-EU rhetoric was part of a path to power in Poland, it became a mechanism for retaining power in Hungary. It served Orban well to distract from his and his party, Fidesz’s, raid on institutional strength and rule of law. Orban, now the country’s longest-serving prime minister, has been on quite the ideological journey. Bringing Fidesz along for the ride, Orban made the move from center-right, classical liberal, and pro-European to right-wing national conservatism and some would say, kleptocracy. This change led to Fidesz’s temporary expulsion from the European Peoples’ Party as well as its eventual permanent exit after the introduction of Rule of Law language in the EPP’s bylaws.

Between 2010 to 2020, Hungary dropped 69 places in the Press Freedom Index and 11 places in the Democracy Index; Freedom House no longer categorizes the country as ‘free.’

Since 2015, Poland has dropped 44 places in the Press Freedom Index. From 2015 to 2020, Poland recorded the biggest decline of any country in the World Justice Project’s Rule-of-Law Index and dropped six places in the Economist Intelligence Unit’s Democracy Index (where it is now classified as a “flawed democracy”).

The EU has hit back at the countries, but not about its barbs. It openly criticized the deterioration in rule of law, human rights, and media freedom in the countries and stated it was in direct opposition to the EU’s shared values and baseline rules for membership. It triggered Article 7 proceedings in December 2017 for Poland and September 2018 for Hungary.

Before the EU could begin Article 7 deliberations, it paused them in light of COVID and the global pandemic. In the meantime, both countries have continued their attacks on rule of law culminating in the latest court decision in Poland that the Polish constitution has primacy over EU law, challenging the bedrock of the EU’s foundation.

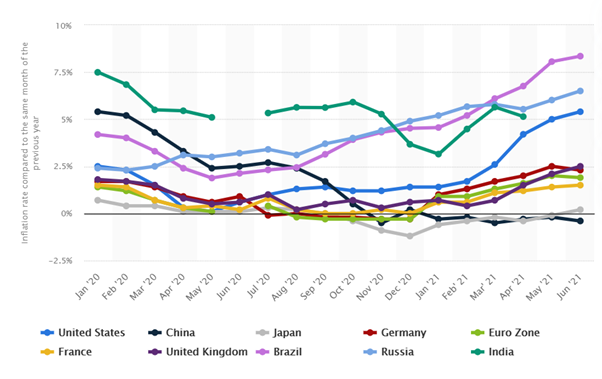

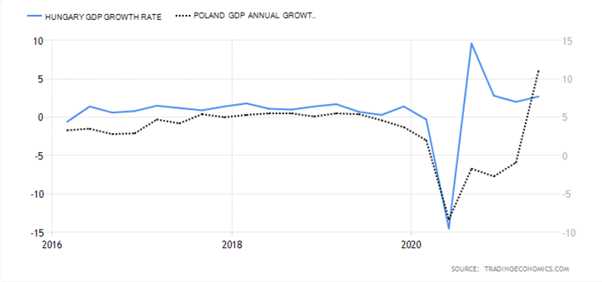

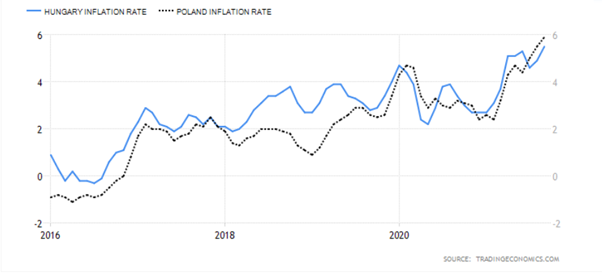

There is no interesting economic backdrop to these governments’ current political path. The economies have benefited immensely from being part of the EU and there is no desire to leave the EU. Currently, the countries are recovering from the pandemic and trying to face down inflation. This is a unique situation in that the power grab needs an enemy and Brussels, and its overarching liberal philosophies are it.

At this point, it is unlikely the EU will be quiet or passive. It no longer has German Chancellor Angela Merkel reigning in any conflict between the eastern countries and Brussels. Patience is wearing thin. It is difficult to see the EU disbursing €36bn in pandemic recovery funds to Poland and the €7bn to Hungary while the question of adherence to EU law and human rights, corruption, etc remains unanswered. Poland is also due to receive €121bn and Hungary €38bn in EU development aid by 2027. Surely EU taxpayers will be up in arms about those disbursements and Polish and Hungarian voters will be as well.

Will Polish and Hungarian voters bite their administrations before Brussels gets the chance?

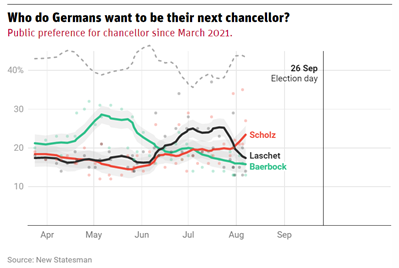

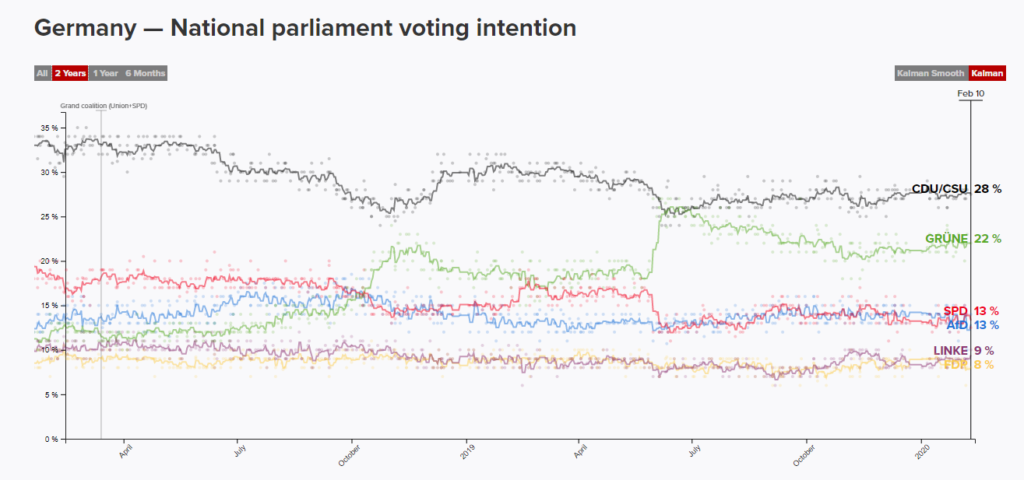

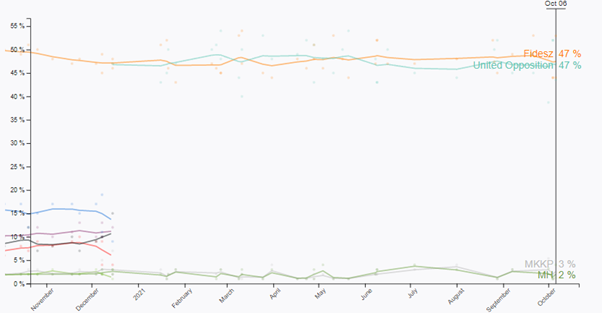

Hungary’s next election is in 2022 and a large part of the opposition has joined together, across the spectrum, to try to beat Orban and Fidesz. On Sunday 17 October Conservative politician Péter Márki-Zay won the primary to be the opposition’s candidate for prime minister. He won’t have an easy job as recent pollings put the two groups on even ground. However, the debate is being framed as ‘Orban or Europe’ and that polling is more decisive.

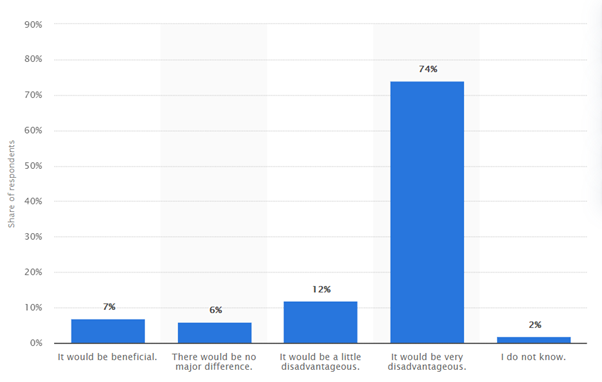

In your opinion, what would be the consequences if Hungary left the European Union?

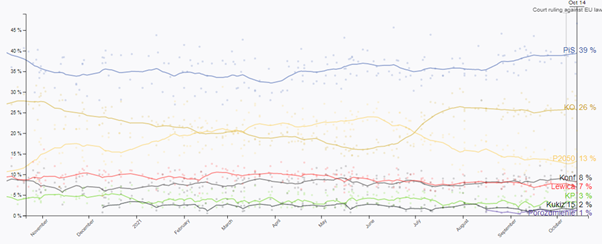

Poland is due for its next election in 2023. The polls there suggest no domestic pressure on PiS from Tusk’s opposition. Will this change when there is a risk to roughly 30% of GDP worth of aid from the EU over the next 6 years?

The EU is a different animal today. Its passivity shouldn’t be taken for granted. Firstly, with Merkel gone, there is a different level of cooperation and power-sharing than before. Second, the EU seems emboldened to act after years of talking and it has significant financial levers available. Thirdly, the upcoming election in France is likely to add to anti-Brussels rhetoric. The EU won’t be able to actively push back against French politicians but it can show its strength via asserting its authority in Poland and Hungary.

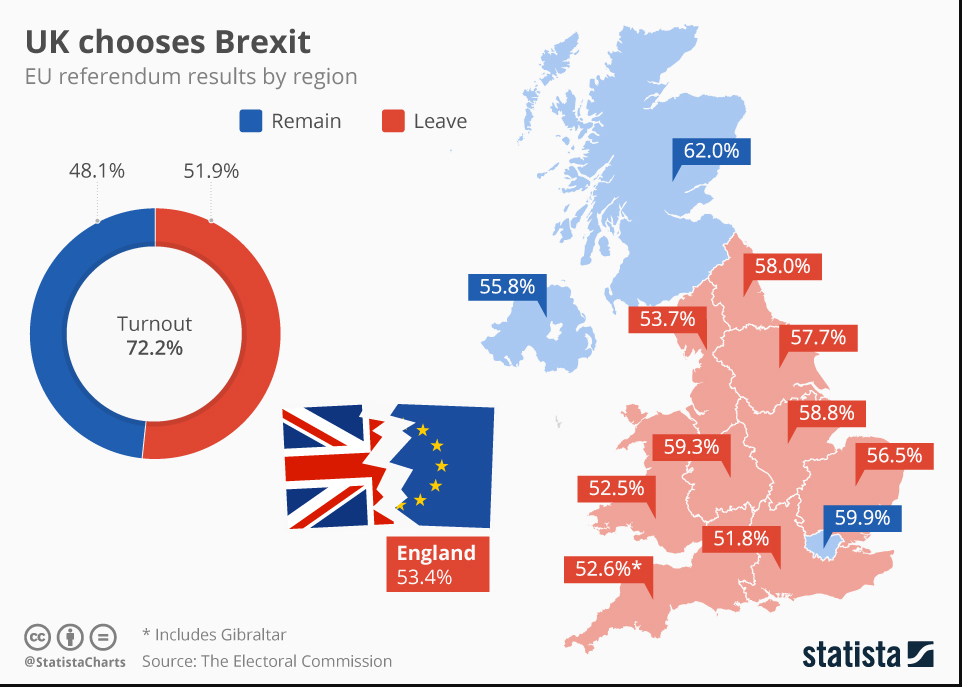

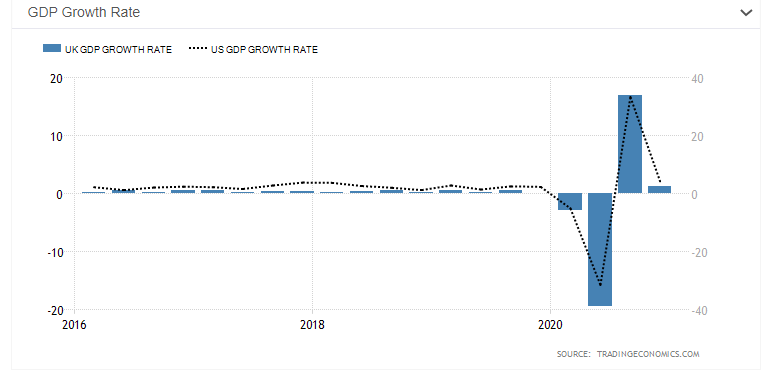

The EU was able to make the UK’s exit fairly painful by following the rules. It is likely it will apply that same process to Hungary and Poland. It will do so with a very large amount of money behind its threats.

Will voters in Hungary beat the EU to the punch? If Hungary can shake loose of Orban’s authoritarian grasp, Poland loses its ally and likely its bravado. If Orban remains, then the EU will act. It is only a question of time and which bear, but the bite will come.

Feel free to file under Poland and Hungary: EVENTUALLY YOU GET BITTEN